Juror Attitudes in the Age of the Coronavirus: Is Big Business Still the Bad Guy?

The data referenced in this article was collected in March and May of 2020 as part of our 2020 Juror Attitudes in the Age of the Coronavirus survey. This article should be reviewed in conjunction with our overview article. For a copy, please contact trialservices@uslegalsupport.com.

The statements, opinions and results listed in this document may change as the landscape caused by the pandemic evolves. It should also be noted that the data for our studies came from large metropolitan areas, are general in nature, and the findings might not be applicable to specific fact patterns or other venues. To determine if these findings apply to a specific case or in a particular venue, DecisionQuest recommends that counsel conduct case- or venue-specific jury research.

Introduction

There has been much speculation over the past months in the legal and business communities about how the COVID-19 pandemic might affect jury decision making once trials resume. Corporate litigants have expressed concern about how they will be perceived by jurors, particularly if jurors are uncomfortable being in a courthouse or courtroom. Who will they hold responsible for the economic downturn? Will jurors be more critical of corporate plaintiffs or defendants? Will they be more inclined to punish corporations by awarding higher damage awards?

We are in unchartered waters. The economic and psychological damage the pandemic has caused, and will continue to cause, will affect juror decision making in the future. History has many examples of large-scale events (the Great Depression, World Wars I and II, the Vietnam War, 9/11, and the more recent Great Recession) affecting human behavior for the rest of a person’s life. When people are facing difficult times that are largely out of their control, it is quite common for them to look for outside targets to vent their frustrations, fear, anger and blame. While it was much easier for the public to draw a direct causal link between big business and the economic downturn during events like the Great Recession, there is no obvious causal link between corporations and the COVID-19 crisis. However, the lack of a causal link does not necessarily mean that, in times of great stress, people will not see one.

DecisionQuest has been working to answer these and other questions on jury decision making for our clients for over 30 years. As with the 9/11 terrorist attacks and the 2008 – 2011 Great Recession, we wanted to understand how these life altering events of COVID 19 could affect our clients’ cases. To this end, DecisionQuest has been collecting data from across the nation to take the pulse on jurors’ attitudes across a large range of topics for decades. These topics include, but are not limited to, attitudes towards corporations, insurance companies and litigation in general. This treasure trove of data gives DecisionQuest the ability to track trends and changes in juror attitudes across time and events.

In March 2020, and again in May of 2020, soon after the realization that America was going to experience a oncein-a-century medical and economic crisis, DecisionQuest surveyed roughly 1,900 jury-eligible adults in multiple metropolitan areas across the country using its CaseXplorer® survey tool. These are the same venues that we have sampled for our national jury survey for decades which allow us to track changes in attitudes across time and events.

Overview of the study

The present article describes a subset of findings from two waves of a planned multi-wave survey. The first wave sampled 896 jury-eligible adults in six large, metropolitan areas (Los Angeles, San Francisco, Chicago, Miami, New York City and northern New Jersey) between March 27th and March 31st, 2020. Virtually the same survey was fielded again between May 7th and May 19th, 2020, to 1,000 respondents in five of the same geographical areas, but with Houston and Minneapolis/St. Paul replacing San Francisco. As is common in longitudinal studies, some venues will remain the same while others will change to include additional high-litigation jurisdictions as the project proceeds. This approach allows us to not only cast an even wider net to allow for additional analyses such as crossvenue comparisons for juror profiling, but also to examine historical trends in particular jurisdictions.

General Impact of COVID-19

Other DecisionQuest articles discuss in more detail jurors’ reactions to the COVID-19 crisis but we can offer a quick review here. Overall, most respondents were somewhat to very concerned that they or someone they knew would be infected with COVID-19; this did not change between March (84%) and May (82%). However, more respondents did report in May than in March that they or someone close to them had gotten sick from the virus; 24% reported an illness in May compared to 16% in March. Given the larger number of active cases in the U.S. in May compared to March, this is not surprising.

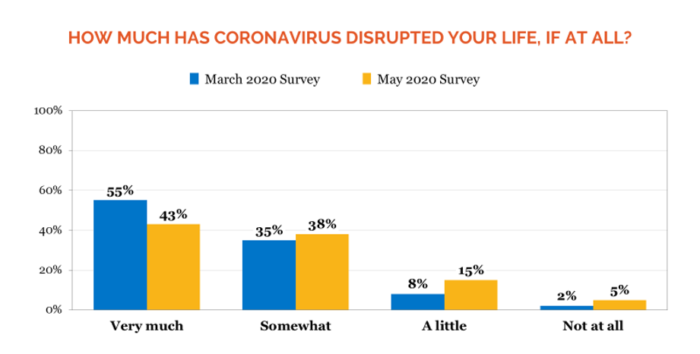

Almost one-third of respondents in both surveys reported that they or their spouse/significant other lost their job because of COVID-19. However, a large majority of respondents reported that COVID-19 has disrupted their lives at least somewhat, indicating that they are experiencing many disruptions other than just job loss. Interestingly, the number of respondents saying it had disrupted their lives “very much” went up by 12 points (from 43% in March to 55% in May) and more respondents reported little to no disruption (10% in March compared to 20% in May ). This seems counterintuitive, given they had had two additional months of staying at home from most activities (working, dining out, school, childcare, exercise, etc.). It is possible that many respondents had just gotten used to it – the amount of disruption was relative. (Note that these reactions were assessed prior to the social injustice protests in the spring of 2020.)

Government Regulations of Corporations

A common effect of the Great Recession was a notable increase in anger toward corporate America. Data from previous DecisionQuest surveys indicated growing anger at corporations and we saw the same sentiment from mock jurors across the country. In short, they blamed corporate America for causing the recession and were angry when corporate America got bailed out but the average American did not. Almost ten years later, we still see that seems to be a healthy skepticism of corporate America.

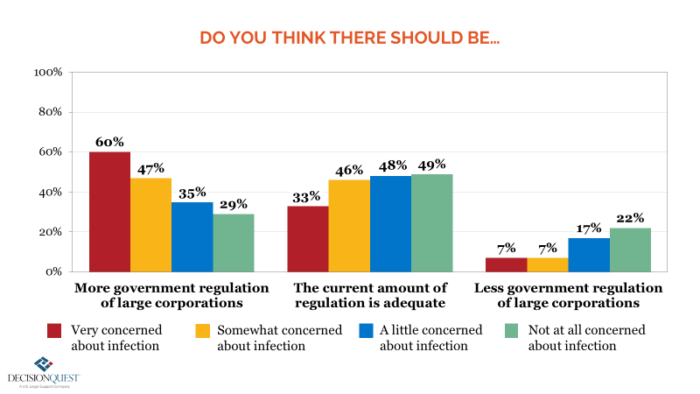

Overall, respondents were largely supportive of government regulation of large corporations. Most (72%) felt government regulation of large business is necessary to protect the public interest. When asked about whether there should be more or less government regulation, very few respondents across both surveys wanted less regulation of large corporations. Rather, a little over half wanted more regulation of large corporations and the remainder (35% – 40%) believed the current amount of government regulation of large corporations was adequate.

There was a statistically significant relationship between a desire for more or less government regulation and concern about COVID-19 infection – the more concerned respondents were, the more supportive they were of more regulation. Conversely, the less concerned respondents were, the more supportive they were of less government regulation. This was true in both March and May. This is not surprising – a fundamental tenet of tort litigation is that fear favors plaintiffs. People who are more prone to see danger (i.e., more risk-averse) are also more prone to want protection from that danger; jurors who are more afraid of injury (either physical or economic) are also more likely to want safeguards against such injury. On the other hand, those who see government oversight as unnecessary or even problematic are more likely to also be less concerned about the current risk.

Opinions of Large Corporations

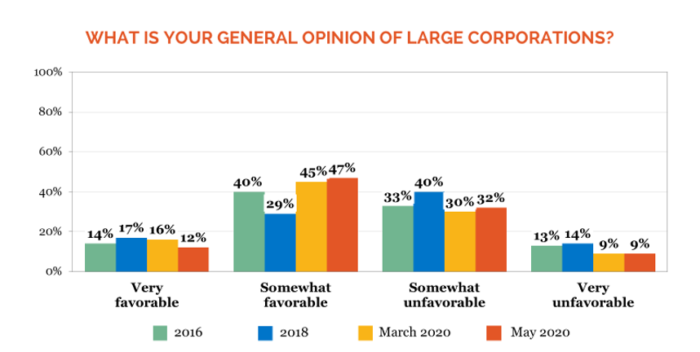

Given how public opinions about corporations changed after the Great Recession, none of these findings are surprising. As the public faces greater risk, uncertainty and pain, they want more protection from risk and look at whom to blame for the uncertainty and pain. Interestingly, however, the recent data suggests people are not blaming corporate America for the current crisis (unlike after the Recession). The data also indicates a slight improvement in general opinions of large corporations since 2016 and earlier (a trend that might vary by age, race, gender and venue).

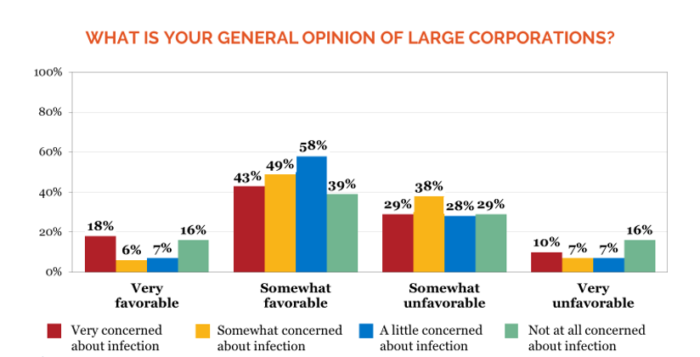

Similarly, a Gallup survey also indicated an increase from 2018 to 2020 in the number of respondents who were satisfied with the size and influence of major corporations in the U.S. (34% to 41%). While this does not indicate a corporate renaissance, it might indicate a slight lessening in the general distrust of corporations during this current crisis. Interestingly, this more positive opinion of corporations was more pronounced among those respondents who were very concerned about infection, while those not at all concerned were more likely than others to have very negative opinions of large corporations. While more concerned respondents wanted more government regulation of large corporations, they also held slightly more favorable opinions of corporations (and vice versa, those who are the most unfavorable toward large corporations were also more likely to be the least concerned about infection).

Somewhat surprisingly, respondents who had been personally impacted by a job loss due to the virus (either theirs or their significant other’s) held just as, or more, favorable opinions of large corporations as those who had not experienced job loss. Contrary to what one might expect, those who had experienced a job loss did not seem to be blaming large corporations for that loss.

Anger Towards Corporate America

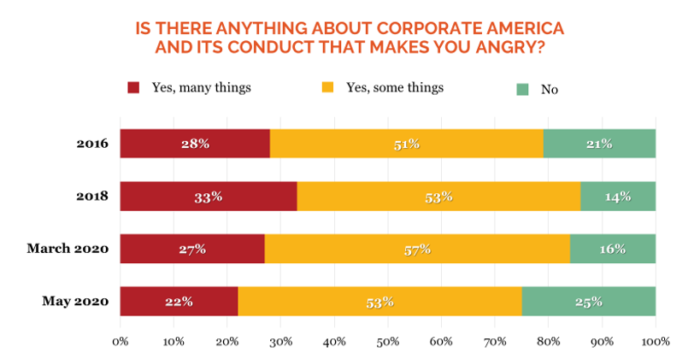

Much like overall opinions of large corporations, anger at large corporations is still notable but also lessened somewhat recently. A large majority (79%) of 2016 survey respondents said there is at least something about corporate America that makes them angry. However, while respondents’ anger at corporate America and its conduct experienced a small increase in 2018, it seemed to drop by March 2020 and was even lower than 2016 levels by May 2020.

As with opinions of large companies, both March and May respondents’ levels of concern about COVID-19 infection were associated with anger at corporations, in the opposite direction of the previous question. Those who reported being very concerned about infection were more likely to report there were many things about corporate America that makes them angry, while those who were not concerned were more likely to report that nothing about corporate America makes them angry. Unlike general opinions toward large corporations, heightened levels of concern were associated with more anger toward corporations, not less.

What is Really Going On?

Some of these findings are counterintuitive to what we might expect. We often observe that mock jurors who are more afraid of what is going on around them, particularly those who have experienced a severe negative event like losing a job, tend to be more anti corporation. While it is not surprising to see that those who are more concerned find more corporate behavior to be angry about, it is surprising to also see those same concerned respondents feel more favorably towards corporations in general (whether or not they have lost a job because of the virus). These results are particularly surprising given the samples are from large metropolitan areas, which tend to be more liberal and historically more critical of corporations. [1] It should also be noted that in the March to May same-city analyses, we observed a great deal of stability. So why have some opinions of large corporations experienced an upturn now? And why is this different from the last national crisis, the Great Recession, during which large corporations took the brunt of the blame? And why is there a slight uptick in general opinions of corporations but not in more specific opinions related to corporate behavior and regulation?

Jury research after the 2008-2011 financial crash indicated that people who were hurt by the recession believed large corporations helped cause the recession – they were to blame. In the crisis we now find ourselves, the cause is external – COVID-19. Here, given this particular crisis, people may also be looking to corporate America for support during the crisis and following recovery. We need large companies to make PPE and vaccines, treat patients and manufacture and deliver products to help keep us safe.

We also know that, in times of stress and hardship, we are more likely to engage in “Us” v. “Them” behaviors. We band together to fight the common enemy. For many people in 2008-2011, the “Us” were the people hurt by the recession and the “Them” were the financial institutions and other large corporations who they felt were to blame. Now, the “Them” is the virus.

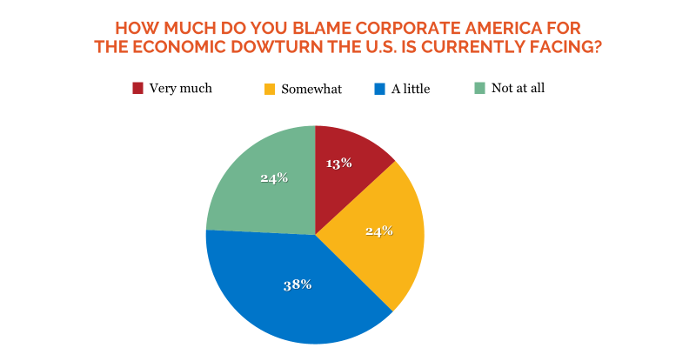

Another component may be that many of the respondents impacted by job loss had no reason to blame large corporations for the loss. To this point, May survey respondents were asked to what extent they blamed corporate America for the current economic downturn, and about two-thirds (64%) of respondents said very little to not at all. While those who were most concerned about COVID-19 infection were a bit more likely to ascribe some blame to corporate America than those less concerned or unconcerned, even among that population fewer than half did so.

Large corporations have been better able to weather the storm than small, local businesses. Jurors in need of work might see larger companies as part of the solution rather than the problem, particularly given how many small businesses are concerned they will not survive COVID-19. To hold a negative opinion of large companies could lead to cognitive dissonance. In many cases, it is easier for those experiencing such conflict to alter their opinions than their behavior. Therefore, it is easier to change an opinion about large corporations than to change where to look for help.

But why the improvement in general opinions of large corporations, but not in specific attitudes about corporate behavior? One possibility is that that our respondents are trying to be both realistic and hopeful and hope is a powerful emotion. Realistically, the majority of respondents believe large corporations do things that can be frustrating and push boundaries, but they are also the source of jobs and economic prosperity, especially in large metropolitan areas. Respondents could be keeping one eye on big business and one eye on their future job prospects – in other words, hoping for the best while trying to prevent the worst.

Attitudes Toward Insurance Companies

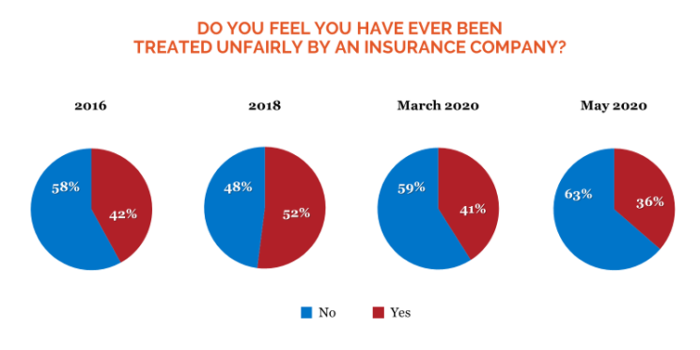

In this current study, unlike for corporations, there was little good news for insurance companies. On one hand, there appeared to be slightly fewer reports of unfair treatment by insurance companies than in the previous 2016, 2018, or March 2020 surveys and we know from our experience that personal experiences are more relevant to actual juror decision making than general opinions, but the results are generally consistent across time.

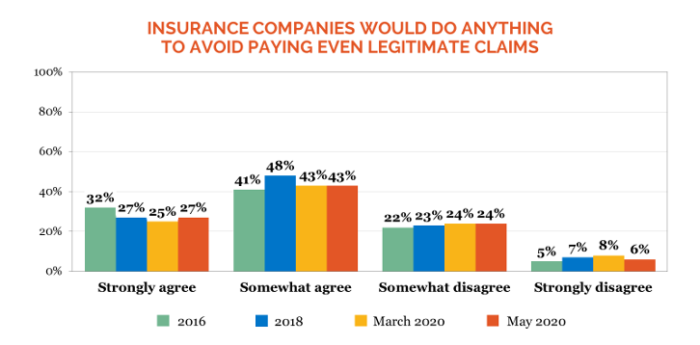

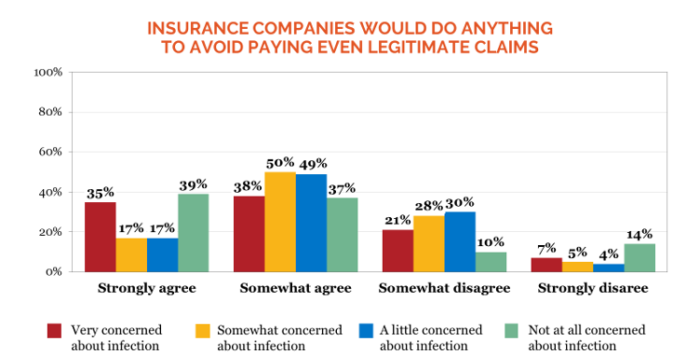

On the other hand, respondents’ general feelings toward the insurance industry are fairly negative (more so than attitudes toward large corporations) and, unlike general opinions toward large corporations, they are not improving. The majority of respondents in the 2016, 2018, and both 2020 surveys (68% – 73%) agreed insurance companies will do anything to avoid paying even legitimate claims against their policies.

Unsurprisingly, given the high level of suspicion of insurers, the majority of survey respondents (67% in May 2020) believed there should be more government regulation of the insurance industry; this belief has also remained relatively stable over the last several years.

As with attitudes towards corporations, we also looked at whether concerns about COVID-19 were correlated with attitudes toward insurance companies. Those most concerned about infection were more likely to strongly agree that insurance companies would deny legitimate claims, and those least concerned about an infection were more likely to strongly disagree (and strongly agree, interestingly) that insurance companies deny legitimate claims. It is possible that their fear of infection includes fear of the aftermath of an infection, including health or other insurance claims being denied.

Any goodwill benefiting corporations during this pandemic does not seem to carry over to the insurance industry. This is really not a surprise, as insurance companies have often been at the center of post-crisis complaints and litigation, and this pandemic does not seem to be an exception to the rule – almost immediately after state and city shutdowns began, so did lawsuits against insurers.

Attitudes Toward Litigation

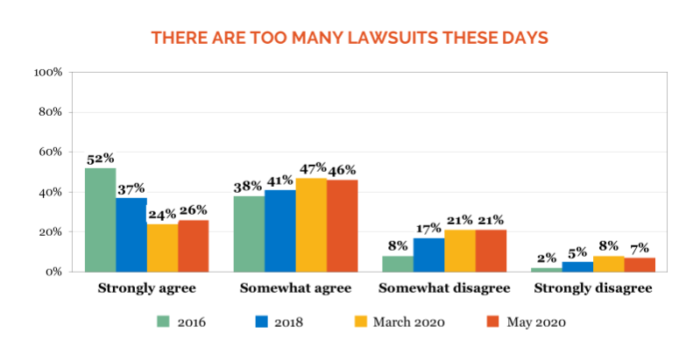

For many years, advocates for tort reform argued that the U.S. was too litigious and jury damage awards were out of control and needed to be curbed; public opinion and legislation followed. [2] However, DecisionQuest national survey results from 2016 onward show a downward trend in concerns about the misuse of litigation and inflated damage awards across the country and that trend continued into 2020. For example, the number of those strongly agreeing that there are too many lawsuits dropped from 52% in 2016 to 26% in May 2020.

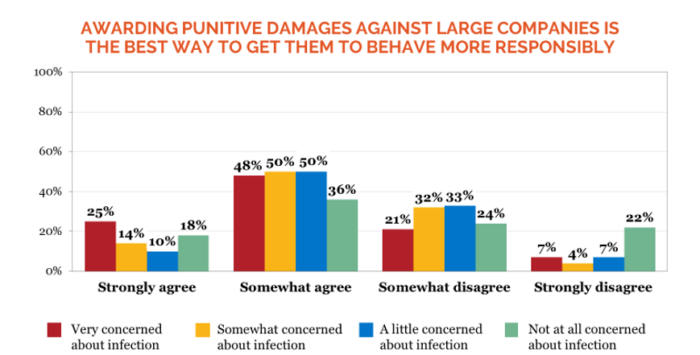

Survey results also show less criticism of damage awards, with more respondents believing damage awards are about right or (for a small number of respondents) too low in more recent years. Finally, while the majority of survey respondents over the last four years generally support the use of punitive damages to enforce corporate responsibility, that support has also tempered over time.

As with previous attitudes, concern about infection was associated with a desire for protection from entities that could do them harm. Those most concerned about infection most strongly supported the use of punitive damages, while those least concerned about infection were the least supportive, again reflecting an association among fear, punishment and blame.

Concerns About Jury Duty

As of this writing, courts are in various stages of rescheduling jury trials, or at least discussing how and when to resume them, and are considering multiple options and scenarios. One suggestion has been to excuse for cause or postpone jury service for any juror who expresses serious reservations about serving as a juror. This suggestion has led to concerns that doing so could disadvantage one set of litigants over another. We wanted to look more closely at how concerns about serving as a juror intersected with other attitudes and opinions, including opinions toward corporations. In order to do that, we included in the May 2020 survey an additional set of questions that asked about respondents’ concerns about serving as a juror at some point between now and October 2020. For example, respondents were asked how concerned they would be about their health in a courtroom and whether they would complete or postpone their jury service.

Two-thirds of respondents said they would be somewhat to very concerned about their health being in a courtroom between now and October 2020 and, unsurprisingly, the more concerned respondents were about COVID-19 infection, the more concerned they would be about being in a courtroom. However, a majority (62%) of respondents said they would report for jury duty, while only 38% said they would request a postponement; that did not change based on how concerned respondents were about infection. Even some of those who were very concerned about infection would still report for jury service, indicating the reasons for being willing to serve or wanting a postponement were more than just concern about COVID 19 (e.g., a sense of civic responsibility, deference to authority, or simply a desire to avoid the experience altogether).

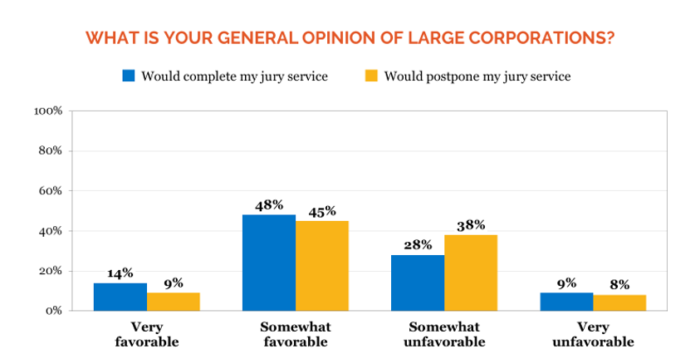

There was, however, a statistical relationship between a respondent’s desire to postpone jury service and opinions of large corporations. Respondents who reported a preference to postpone their jury service were slightly more likely to hold unfavorable opinions of large corporations than those who would complete their jury service (46% v. 38%).

There was no relationship between a desire to complete or postpone jury service and attitudes toward insurance companies – those choosing to serve or postpone were no more or less favorable or suspicious toward insurance companies. On the other hand, like those who were more concerned about COVID-19 infection in general, those who would be more concerned about their health in a courtroom were more negative toward insurance companies (e.g., they believed insurance companies should be more heavily regulated) and those less concerned were more positive (e.g., they were more likely to reject the idea that insurance companies would do anything to deny even legitimate claims).

Those who would postpone their jury service, or who would be more concerned about their health in a courtroom, were also more supportive of using punitive damages to police corporate responsibility. Similarly, those who would be concerned about their health in a courtroom were also more supportive of increasing government regulation of large corporations. These data indicate that either allowing jurors to choose to postpone their jury duty or removing for cause those who are the most concerned about their health would likely lead to a more corporate- and insurerfriendly jury pool.

What is the Bottom Line?

Despite a persistent concern about large corporations over the last several years, respondents in our study have a more complicated perspective on large corporations after having experienced COVID-19. While having lost a job or general concern about infection might lead to a slightly more positive opinion of large corporations in some ways, they did not mitigate respondents’ desire to carefully regulate and monitor them and concern about serving on a jury was related to more negative impressions of large corporations. As is often the case, there is more to the story than a simple “jurors like companies in a healthcare crisis” explanation.

Insurance companies are not getting the same small boost of support that large corporations received, however, possibly in part because of preconceived expectations that they’ll find a way to deny claims even during a national crisis. Though our current data cannot directly answer this question, it is also possible that – at a time of very high unemployment rates – people have a heightened concern about how to pay for medical bills or other losses incurred during the pandemic, particularly because, for many, health insurance is tied to their employment.

Fear, anger, punishment and blame play important roles in how jurors attribute fault, determine liability and assess damages. It is a common myth that sympathy alone drives verdicts. For defendants, the more deadly combination is jurors’ sympathy for the plaintiff, anger at the defendant and fear that they could suffer the same fate as the plaintiff.

It is important to note that, based on the data from this study, litigation is still seen as a necessary way to keep large companies honest, now even more so than 10 years ago after the Great Recession, and heightened levels of concern are still more likely to be correlated with other anti-corporate, pro-regulation attitudes and punitive damages sentiments. If companies keep doing what they can to visibly help their customers survive the COVID-19 crisis, they will likely continue to earn some increased goodwill with jurors. Note, for example, the positive media coverage generated by tech companies offering free usage of their platforms, the Dallas Mavericks owner Mark Cuban reimbursing his employees’ purchases from independent local cafes, restaurants delivering free meals to healthcare workers, distilleries using leftover alcohol to make hand sanitizer and automakers using their facilities to manufacture ventilators.

However, if companies are perceived to be taking advantage of the situation, placing their profits over the safety of their employees or the public or unfairly benefitting in some way from the current situation, that goodwill could boomerang into the sort of anger and skepticism we saw after the Great Recession. Examples of corporate missteps that could turn the tide against some corporations could include the large corporations that received over $1.3 billion in Payroll Protection loans, several of which (including the Los Angeles Lakers) were publicly shamed into returning the money to the fund. [3] Other possibilities could be corporations that take advantage of people in their time of need (e.g., price gouging, favoritism for larger clients, taking PPE funds but also laying off employees, etc.).

Jurors were angry at corporate America after the Great Recession and took it out on corporate defendants. In order to minimize the opportunities for that to happen again, companies should do their best to develop strategies that will benefit the public while benefiting themselves. Anything they can do to exhibit that they are helping to lessen the impact of the current crisis on average people and assisting in coming up with ways to get life back to normal for Americans, the greater likelihood they will be rewarded (or less likely to be punished) in the courtroom.

In sum, respondents are still wary of large corporations and even more so of insurance companies but their desire to band together to fight the greater problem and survive this current crisis could be salient enough to give some companies, depending on their role and behavior, some increased benefit of the doubt (which could be magnified if court management policies postpone or excuse those jurors most afraid of participation). However, companies will need to do their part for the greater good to ensure that that goodwill does not dissipate off into the ether.

Get to know Dr. Leslie Ellis and Dr. Stuart Miles.

[1] https://news.gallup.com/poll/5248/big-business.aspx

[2]https://www.americanbar.org/groups/bar_services/publications/bar_leader/2004_05/2906/momentum/

[3] https://www.forbes.com/sites/eriksherman/2020/05/15/ppp-public-companies-federal-loans/#856a79f342ad